SC committee formed to address rising home, liquor liability insurance rates

(WPDE)– For more than a year, residents and businesses across the Grand Strand have dealt with what some lawmakers call a ‘crisis’ in the insurance market.

ABC15 has reported extensively of residents facing insurance providers canceling their policy renewals, moving out of Horry County and other coastal communities, as well as condominium communities forced to go to the secondary insurance market to sign up for policies that double, triple, and even quadruple to costs to protect their homes.

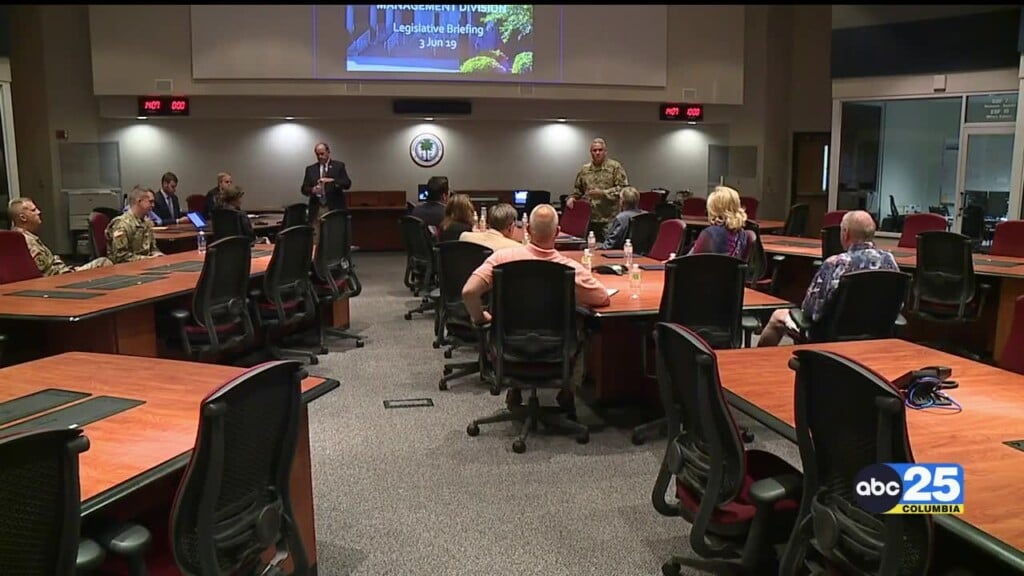

It resulted in a community meeting with the state Department of Insurance late last year. Several special committees were formed to examine insurance fraud and liquor liability laws. Multiple pieces of legislation were written in the 2024 session in an attempt to address the problems. None passed through both chambers to make it to the governor’s desk.

“When you go through all of the work that we had put in place, it was definitley frustrating not to see it go over the goalpost,” said Rep. William Bailey of Little River. “It did make it to the point where I think the Senators saw that it’s a huge issue that they need to take part in a solution.”

That’s were late in the budget-making process, a provision was added that kept the door open for lawmakers to address the issue. Two provisos were included to address the concerning insurance market for property, auto, and business liability.

The study shall include the number of property insurance companies participating in the coastal insurance market, coastal insurance premium pricing, coastal insurance market outlook for the future, possible strategies to stabilize our State’s coastal insurance market, efforts the department may utilize to recruit additional insurance providers, and any other information deemed pertinent to the issue including suggested statutory changes.

The proviso requires that the DOI have this study complete no later than October 1. By then it will be in the hands of lawmakers on a new joint insurance study committee. Rep. Bailey is the lone lawmaker from the coast selected to take part in the six-member committee.